are inherited annuity payments taxable

Qualified Annuity Taxation Example. When does the 10 penalty tax.

Tax Troubles With Annuities Ann Arbor Investment Management Vintage Financial Services

Spousal continuation of ownership - As spouse of the decedent and as the sole designated primary beneficiary under the contract s I wish to continue the contract s as outlined in the.

. When you receive payments from a qualified annuity those payments are fully taxable as income. An annuity is a product created and sold by financial companies that gives out a stream of payments to an individual either at a fixed or. If a non-qualified annuity pays the owner payments for their entire life the exclusion ratio will take their life expectancy into consideration.

This is based on how long your annuity was how much money you paid in and how much money you got out. In other words you have to pay ordinary income tax on the earnings part of your distributions. Once the total amount of the investment in the contract is recovered using the exclusion ratio the annuity payments are fully taxable.

For IRAs the entire amount will be reported as taxable income. If the owner dies before the total investment in the contract is recovered and annuity payments cease as a result of his death the un-recovered amount is allowed as a deduction to the owner in his last taxable year. For example if your calculated life expectancy is 82 years old the exclusion ratio will determine how much of each payment from your non-qualified annuity will be considered taxable earnings until you turn 82.

When an annuity payment is made 50 of each payment would be income taxable. If the contract was purchased with after. After the age of 82 all payouts from the annuity are considered taxable income.

Last In First Out LIFO. But there is no 10 early withdrawal penalty to worry about and you dont have to deal with RMDs either. Annuitized Annuity Payments Exclusion Ratio.

But annuities purchased with a Roth IRA or Roth 401k are completely tax free if certain requirements are met. If the payout is over an annuitants lifetime and the annuitant outlives life expectancy all further payments are subject to ordinary income as received. All payments beyond the annuitants life expectancy are taxed as income.

The type of annuity you. After the fixed-interest rate expires the. However any growth or earnings on your initial investment are tax deferred.

Thats because no taxes have been paid on that money. Table A Examples of Taxable Income Examples of income to consider when determining whether a return must be filed or if a person meets the gross income test for qualifying relative Wages salaries bonuses commissions Alimony for divorce before 2019 see HowWhere to Enter Income later Annuities Awards Back pay Breach of contract payment Business. An adjustable-rate mortgage ARM with an initial fixed-interest-rate period.

Report the taxable portion of the claim payment as taxable income on Form 1099-R for the calendar year of payment. The contributions made to a non-qualified annuity arent taxable.

Taxation Of Annuities Ameriprise Financial

Annuity Beneficiaries Inherited Annuities Death

Inherited Annuity Tax Guide For Beneficiaries

Annuity Taxation How Are Annuities Taxed

Annuity Exclusion Ratio What It Is And How It Works

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Annuity Taxation How Various Annuities Are Taxed

Annuity Tax Consequences Taxes And Selling Annuity Settlements

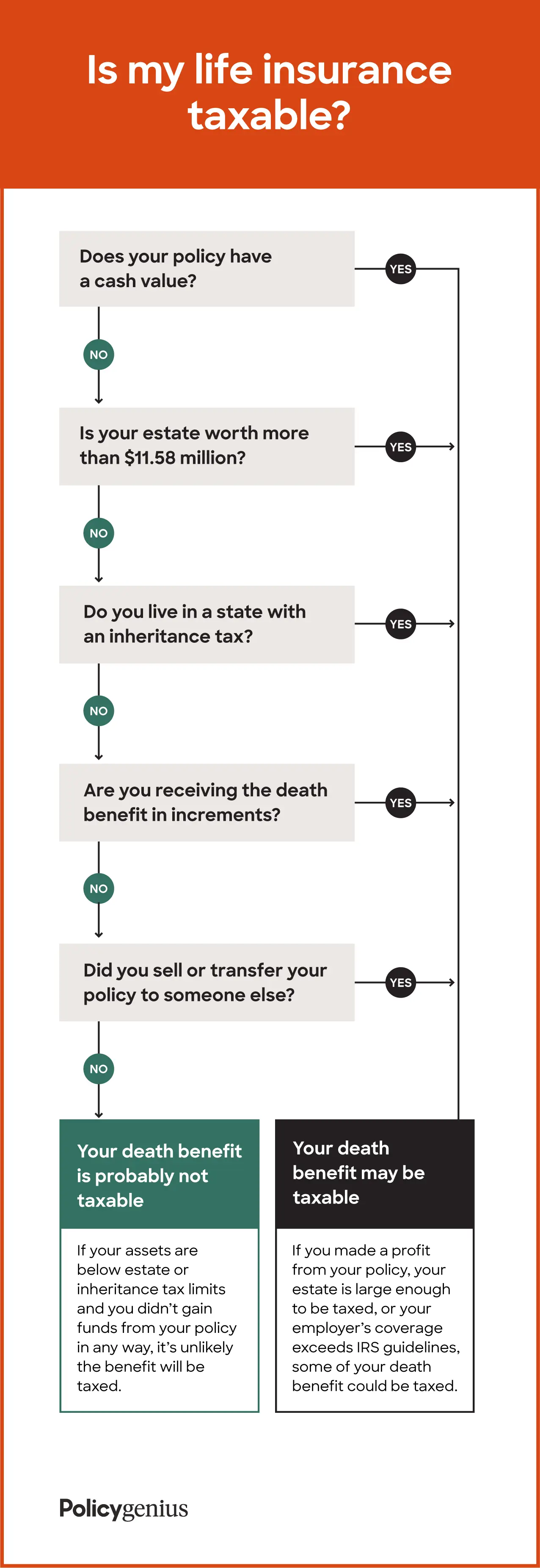

Is Life Insurance Taxable Forbes Advisor

Annuity Taxation How Various Annuities Are Taxed

Annuity Beneficiaries Inheriting An Annuity After Death

:strip_icc()/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

Is Life Insurance Taxable Policygenius

Annuity Tax Consequences Taxes And Selling Annuity Settlements

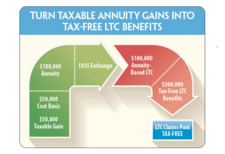

How To Use Annuities To Pay For Long Term Care Costs Tax Free Long Term Care Insurance

How To Avoid Paying Taxes On An Inherited Annuity Smartasset